We have been sold a lie. It is a comfortable, well-packaged lie wrapped in a glossy brochure from a wealth management firm, but it is a lie nonetheless.

For the last forty years, the roadmap to financial freedom was simple: Work hard, save 20% of your income, and dump it into a “balanced” portfolio. You know the drill. The classic 60/40 split—60% in a diversified stock index and 40% in “safe” corporate or government bonds.

The logic was seductive. When stocks go up, you win. When stocks go down, bonds (theoretically) go up or stay stable, cushioning the blow. It’s the “sensible” middle ground. It’s what your parents did. It’s what your HR department recommends for your 401(k).

But here is the uncomfortable truth: The middle ground is the kill zone.

We are living in a completely different economic regime than the one that existed from 1980 to 2020. That era was defined by falling interest rates and low inflation. In that environment, the 60/40 portfolio was a golden ticket.

Today? We are facing sticky inflation, geopolitical instability, and a massive debt overhang. In this environment, the “safe middle” guarantees you two things:

- You will slowly bleed purchasing power due to real inflation.

- You will still be exposed to massive drawdown risk when the market corrects.

The ultra-wealthy—the people who actually own the world, not just the ones trying to retire in it—do not invest in the middle. They don’t want “average” returns with “average” risk.

They use a mental model popularized by the mathematical philosopher Nassim Nicholas Taleb. It’s called the Barbell Strategy.

If you are tired of watching your portfolio tread water while the cost of living skyrockets, listen up. It’s time to stop standing in the middle of the road.

Table of Contents

The Mathematics of Ruin: Why 60/40 Failed

Let’s look under the hood of the traditional portfolio.

The premise of the 60/40 portfolio relies on negative correlation. The idea is that stocks and bonds are on a seesaw. When one goes down, the other goes up.

This worked beautifully for decades. But in 2022, we saw the seesaw break. The S&P 500 dropped nearly 20%. In a normal world, bonds should have rallied. Instead, long-term treasuries and bond funds crashed by over 30%.

Why? Because when inflation spikes, central banks raise interest rates.

- Higher rates hurt stock valuations (future cash flows are worth less).

- Higher rates crush existing bond prices (yields go up, prices go down).

Suddenly, there was nowhere to hide. If you were sitting in the “safe middle,” you got hit from both sides.

Furthermore, let’s talk about Real Yield. If your “safe” corporate bond fund pays you 5%, but inflation (the real kind, not just the CPI print) is running at 4-5%, and you pay tax on that interest… your real return is negative. You are taking on risk to lose money slowly.

This is the definition of insanity. You are exposing yourself to potential ruin (market crashes) without any exposure to life-changing upside.

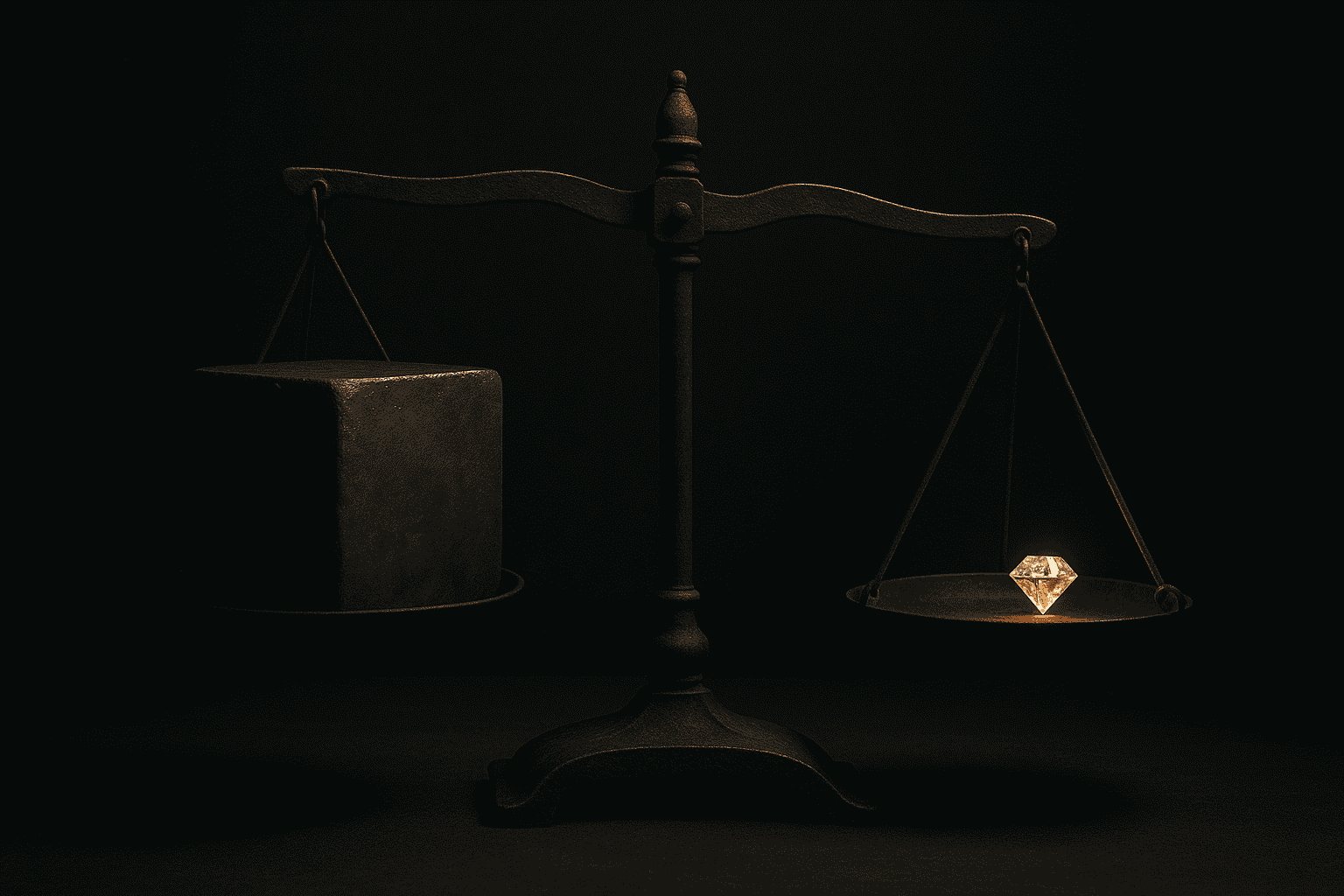

The Philosophy of the Barbell

Imagine a physical barbell at the gym.

- On the far left, you have massive, heavy weights.

- On the far right, you have massive, heavy weights.

- In the middle? There is nothing but a thin steel bar.

This is how you must structure your financial life.

The Concept: You avoid the middle entirely. You allocate the vast majority of your capital to extreme safety (Hyper-Conservatism) and a small sliver of your capital to extreme risk (Hyper-Aggression).

The Goal:

- Survive: Even if the market crashes 50%, your lifestyle is unaffected because your “safe” side is bulletproof.

- Thrive: If just one of your risky bets pays off, it covers all your losses and multiplies your net worth.

This strategy utilizes Asymmetric Upside.

- In the middle (stocks/bonds), you risk $1 to make $1. (1:1 ratio).

- On the risky end (Barbell), you risk $1 to potentially make $50. (1:50 ratio).

If you have limited downside and unlimited upside, you don’t need to be right often. You just need to be right once.

Side A: The Fortress (90% of Your Assets)

This side of the barbell is boring. It is unsexy. It is the bedrock of your sanity.

The goal here is Capital Preservation. If the stock market goes to zero, if the grid goes down, if you lose your job—this money is still there. We are not trying to “beat the market” with this 90%. We are trying to beat anxiety.

Here is what goes into the Fortress:

1. Short-Term U.S. Treasuries (T-Bills)

Forget corporate bonds. Corporate bonds have “default risk” (the company could go bust). The U.S. government (theoretically) cannot go bust because it owns the money printer. Short-term T-Bills (1-3 month duration) are currently yielding decent returns. They are “risk-free” in nominal terms and highly liquid. You are essentially being the bank.

2. High-Yield Cash Equivalents

You need liquidity. Money market funds or High-Yield Savings Accounts (HYSA) allow you to keep powder dry. When the market crashes, the person with cash is King. While everyone else is panic-selling their stocks to pay rent, you are buying their assets for pennies on the dollar.

3. Physical Gold (The Insurance Policy)

Gold is not an “investment”; it is a currency that cannot be debased. Central banks are buying gold at record rates right now. Why? Because they don’t trust the dollar/euro/yen system they created. Allocating 5-10% of your fortress to gold acts as a hedge against extreme inflation or currency collapse.

4. Paid-Off Real Estate

Your primary residence, if you own it outright, is part of the fortress. It reduces your monthly burn rate. It provides shelter. It is a tangible asset that cannot be wiped out by a stock ticker change.

The Rule of the Fortress: If an investment keeps you up at night, it does not belong in this 90%.

Side B: The Moonshots (10% of Your Assets)

Now for the fun part.

Because 90% of your money is in the Fortress, you cannot go broke. This gives you a psychological superpower: The ability to take risks that look insane to average people.

With the remaining 10%, we are hunting for Black Swans—rare events that pay out massively. We are looking for 10x, 50x, or 100x returns.

If you lose this 10%, it stings, but it doesn’t change your life. You still have the 90%. But if this 10% does a 10x? It doubles your entire net worth.

Here is what goes into the Moonshots:

1. Angel Investing / Startups

This was historically reserved for the elite, but platforms like AngelList or crowdfunding sites have opened it up. You are buying equity in early-stage companies.

- Risk: 9 out of 10 will fail (value goes to $0).

- Reward: 1 out of 10 becomes Uber or Airbnb (value goes to $10,000+).

2. High-Conviction Crypto

We are not talking about trading Dogecoin on a Tuesday. We are talking about long-term holds in fundamental protocols (like Bitcoin or Ethereum) or highly speculative plays in emerging tech (DeFi, AI-Crypto integration). Crypto is the only liquid asset class on earth where a 10,000% return is mathematically possible within a few years. It is pure asymmetry.

3. Long-Dated Options (LEAPS)

Warning: Technical. Instead of buying 100 shares of a tech stock (costing $15,000), you buy deep out-of-the-money call options for two years out (costing $1,000). If the stock flatlines, you lose the $1,000. If the stock moons, the leverage in the option can yield 20x returns.

4. You (The Ultimate Asymmetry)

The best risk you can take is on your own skills. spending $5,000 on a mastermind, a course, or starting a side business has infinite upside. If the business fails, you lost $5k. If the business works, it could generate $500k/year forever.

The “Kill Zone”: What You Must Sell Immediately

If you adopt the Barbell Strategy, you must ruthlessly cut out the middle. This is the stuff that feels safe but is actually dangerous.

1. Corporate Bonds: They have capped upside (the yield) but massive downside (default or rate risk). Why take the risk of a company failing just for a 5% coupon?

2. High-Dividend “Yield Traps”: Stocks that pay 8-9% dividends usually do so because their share price is collapsing. You are picking up pennies in front of a steamroller.

3. Index-Hugging Mutual Funds: These are active funds that charge high fees (1%+) just to mimic the S&P 500. Sell them. If you want market exposure, buy the cheap ETF. But in a Barbell, we generally minimize broad index exposure in favor of the edges.

How to Construct Your Barbell (Step-by-Step)

You can’t switch to this overnight without triggering a massive tax bill. But you can shift your strategy moving forward.

Step 1: Audit Your Reality Look at your net worth. What percentage is in the “Safe Middle”? Likely 95%.

Step 2: Build the Fortress Floor Before you buy a single risky asset, ensure you have 6 months of cash and a solid baseline of “boring” assets (T-Bills/Gold). Action: Move your cash from a 0.01% checking account to a 5% Money Market account today.

Step 3: Allocate Your Risk Budget Decide on your number. Is it 5%? 10%? 15%? Let’s say you have $100,000 to invest.

- $90,000 goes to the Fortress.

- $10,000 is your “Venture Capital” fund.

Step 4: Place Your Bets Take that $10,000 and split it into 5-10 asymmetric bets.

- $2k in Bitcoin.

- $2k in an AI startup.

- $2k in a volatile tech sector ETF.

- Etc.

Step 5: The Rebalance Rule This is crucial. If your risky side wins (e.g., your Bitcoin doubles), you harvest the profits and move them into the Fortress. You don’t let the risky side become 50% of your portfolio. You use the volatility to feed the safety.

Conclusion: Surviving the Chaos

The world is getting noisier. The economy is getting more fragile.

The old advice of “buy a mix of stocks and bonds and hold for 40 years” assumes a stable world. We do not live in a stable world. We live in a world of pandemics, AI disruption, and currency wars.

The Barbell Strategy is the only portfolio designed for chaos.

It acknowledges that we cannot predict the future.

- If the world stays the same, your Fortress earns yield.

- If the world falls apart, your Fortress survives.

- If the world changes radically (tech boom, crypto adoption), your Moonshots make you rich.

Don’t be the average investor getting crushed in the middle. Be the investor who sleeps like a baby and invests like a maniac.

Join The Global Frame

Get my weekly breakdown of AI systems, wealth protocols, and the future of work. No noise.