If you open Twitter (X) right now, it looks like the only way to get rich in 2025 is to build an AI agent that automates email or writes poetry.

Everyone is chasing the “next big thing.” They are burning venture capital, sleeping under desks, and fighting for a 0.01% chance of becoming a unicorn.

But while everyone is looking at the clouds, the real money is right under their feet. It’s in the dirt. It’s in the grease. It’s in the businesses that actually keep America running.

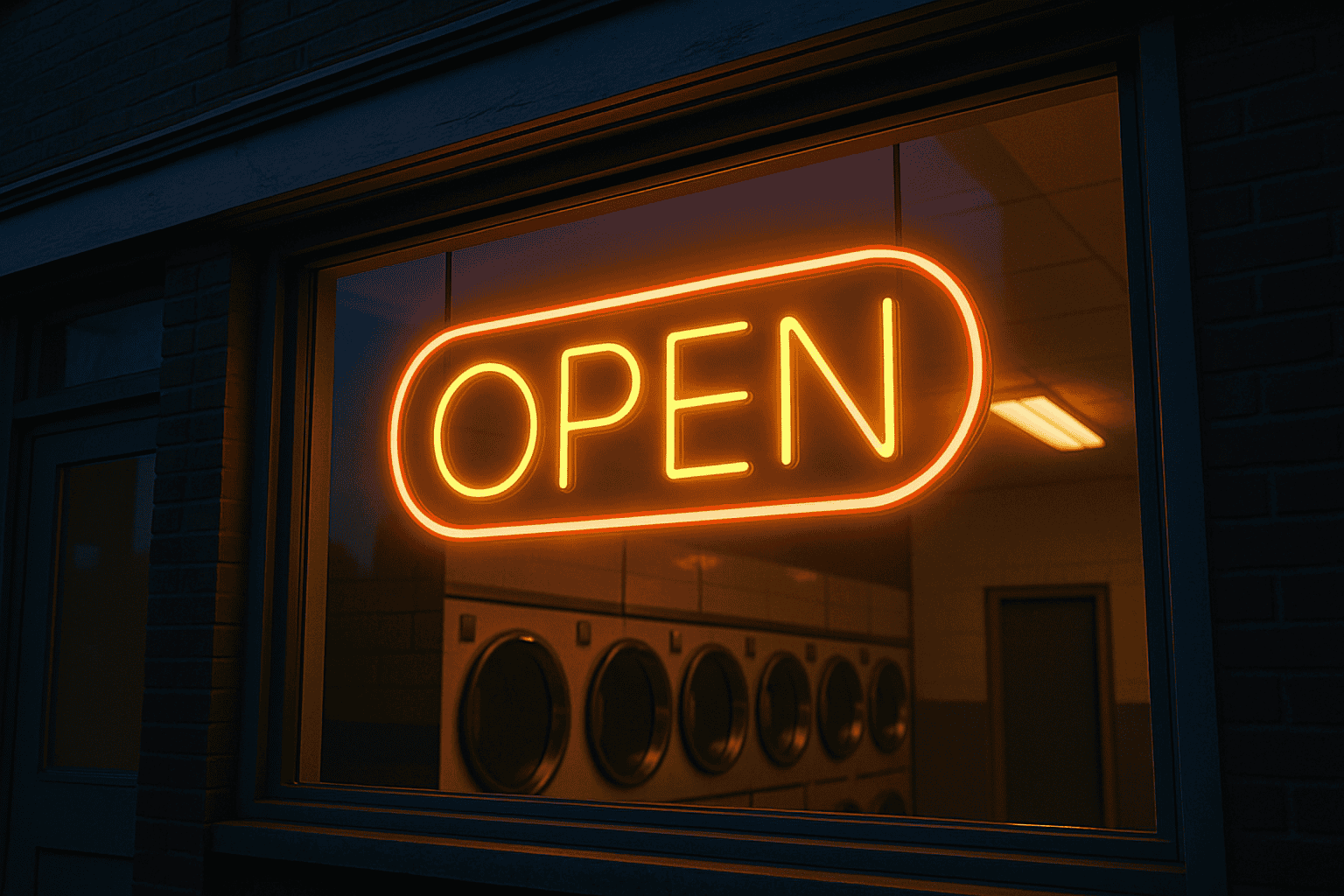

I’m talking about “Boring Businesses.”

Plumbing companies. Laundromats. HVAC repair. Car washes.

These aren’t sexy. They won’t get you a cover story in Forbes. But they have something that 99% of AI startups don’t: Profits from Day One.

We are currently witnessing the greatest wealth transfer in history, and it has nothing to do with crypto. It’s called the Silver Tsunami, and if you are smart, you will grab a surfboard.

Table of Contents

The Silver Tsunami: A Once-in-a-Lifetime Event

Here is the demographic reality: The Baby Boomers own everything.

Specifically, they own about 41% of all small businesses in the United States. That equates to roughly 12 million businesses.

But here is the problem: Boomers are getting old. They are tired. They want to retire, play golf, and visit their grandkids.

They have spent 30 years building a pest control company or a window-washing service that generates $500k a year in profit. Now they want out.

Who are they going to sell to?

- Their kids? No. Their kids went to college and want to work in marketing or tech. They don’t want to manage a fleet of plumbing vans.

- Private Equity? No. These businesses are too small (“Main Street,” not Wall Street). A $2M revenue HVAC company is a rounding error for BlackRock.

This creates a massive supply-and-demand imbalance. There are millions of profitable businesses hitting the market with nobody to buy them. That means buyer leverage. It means better prices and better terms for you.

The “Unsexy” Math: Startups vs. Acquisitions

Why buy a business instead of starting one?

Risk.

If you start a tech company from scratch (Zero to One), your failure rate is terrifying.

- 90% of startups fail.

- 10% fail within the first year.

- Even if you are venture-backed, your odds of a massive exit are statistically near zero.

Now, look at Acquisition Entrepreneurship (buying a business that already exists).

- Product-Market Fit: Solved. People already pay for the service.

- Cash Flow: Immediate. You take a salary the first month.

- Employees: Already hired and trained.

- Brand: Already established in the local community.

You aren’t betting on a “hypothesis.” You are buying a machine that is already printing money. You just need to keep it oiled and maybe upgrade the software.

The Target: What Exactly Should You Buy?

You are not looking for the next Facebook. You are looking for “Lindy” businesses—businesses that have existed for 50 years and will likely exist for 50 more.

Look for the “Sweaty Startup” characteristics:

- Essential Services: Things people need, not want. Toilets break. Roofs leak. Grass grows. Recessions don’t stop these problems.

- Low Tech Risk: A laundromat is not going to be disrupted by ChatGPT next week.

- Local Monopoly: The dry cleaner on the corner doesn’t compete with Amazon. They compete with the other dry cleaner across town who doesn’t have a website.

The “Digital Arbitrage” Play Most Boomer-owned businesses are run on pen and paper. They don’t have a Google Business Profile. They don’t have online booking. They still use fax machines.

If you buy this business and simply add a website, set up SEO, and automate the billing, you can often increase revenue by 20-30% in the first year just by joining the 21st century.

How to Buy a Business with (Almost) No Money

“But I don’t have $1 million lying around.”

You don’t need it. You use the SBA 7(a) Loan.

The US government wants you to buy these businesses because they employ people. So, the Small Business Administration (SBA) guarantees loans for banks.

The Deal Structure: Typically, you can buy a business with just 10% down. The bank covers the other 90%.

But here is the “secret sauce” that changed in 2025: Seller Financing.

In the past, you could sometimes get the seller to cover your entire down payment. As of June 2025, the rules have tightened, but they are still powerful.

- The Rule: The seller can finance up to 5% of the purchase price, but it must be on “full standby” (no payments) for the life of the SBA loan (usually 10 years).

- The Buyer: You (the buyer) must come up with the other 5% in cash.

The Math:

- Business Price: $1,000,000

- SBA Loan (Bank): $900,000 (90%)

- Seller Note (Standby): $50,000 (5%)

- Cash from You: $50,000 (5%)

For $50,000, you can control a $1M asset that might be generating $200,000 – $300,000 in annual profit. That is an ROI you will never find in the stock market.

Warning: The seller effectively locks up their 5% for a decade. This requires negotiation skills, but for a Boomer who wants to protect their legacy, it is often acceptable.

The Protocol: How to Find Your Deal

Don’t just browse BizBuySell (though that’s a start). The best deals are “off-market.”

1. The “Rip the Band-Aid” Search Go to Google Maps. Search for “Plumbers in [Your City]” or “Landscapers in [Your City].” Look for the listings with bad websites or no websites. Look for the ones with 3-star reviews because “nobody answers the phone.” These are your targets.

2. The Cold Outreach Send a physical letter. Yes, paper. “Hi [Name], I’m a local entrepreneur looking to buy a business in the area to preserve its legacy. I’m not a private equity firm. I want to honor what you’ve built. Are you thinking about retiring in the next 1-3 years?”

3. The “Main Street” Walk Walk into local businesses. Ask to speak to the owner. It sounds terrifying, but it works.

The Bottom Line Tech is flashy. Boring is profitable. In a world of artificial intelligence, bet on actual reality. Bet on the things that break, leak, and need fixing. The Silver Tsunami is here—catch the wave.

Join The Global Frame

Get my weekly breakdown of AI systems, wealth protocols, and the future of work. No noise.